News

Commodity codes, explained

01 March 2021

If you move goods to or from anywhere in the world, you will need to use a commodity code to classify your consignment. Here’s what you need to know.

What is a commodity code?

The UK now uses a standardised set of codes, borrowed from the World Trade Organisation (WTO) “Harmonised System”, to classify goods.

These are known as commodity codes.

Commodity codes can contain up to 14 numbers, with each number representing the type of good being transported.

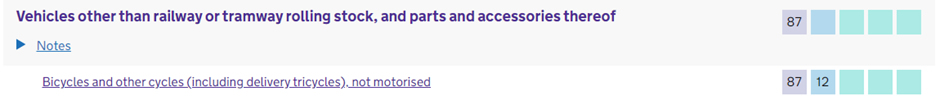

For example, any goods relating to vehicles (other than railway or tramway rolling stock, and parts and accessories thereof) will come under code “87”.

If that vehicle is a non-motorised bicycle, its code would be “87 12”, as “12” is the commodity code for “Bicycles and other cycles (including delivery tricycles), not motorised”.

The next set of numbers would relate to the type of bicycle, and so on and so forth (see below).

EU and WTO rules

Some products have longer commodity codes than others, depending on what the product is, the materials used, the production method, where it comes from, and where it is going.

The UK uses the standard six-digit format adopted from the World Trade Organisation (WTO) for goods shipped anywhere outside of the EU.

Goods shipped to the EU, however, may need additional classification. This will include two additional digits relating to the Combined Nomenclature (CN) heading and up to six additional digits relating to the Integrated Tariff of the European Communities (TARIC) subheading.

You can use the UK Global Online Tariff: look up commodity codes tool to find your commodity code.

If you’re having problems classifying your goods, get in touch with our expert team for support.

Why do I need a commodity code?

Every customs declaration made in or out of the UK requires a commodity code, as it is used to determine the rate of duty and import VAT which should be paid, if the duty is suspended, whether you need a licence to move the goods, or if your goods are covered by agricultural policy, anti-dumping duties, or tariff quotas.

If you use the wrong commodity code, you may pay the wrong import duty and your goods could be seized at the border.

Get expert advice today

For help and advice classifying your goods, please get in touch with our expert Brexit advisory team.

Case Studies

-

Smiles all round for dental practice

-

Customer care is top of the list for packaging business

-

A shared passion for architecture and a head for numbers

-

Child's play with proactive accounts management

-

Taxing demands with old school charm

-

A taste for growth, a thirst for knowledge

-

A modern approach required for music moguls

-

Sometimes a business does exactly as it says on the tin

-

Cut above the rest in personal management style